Introduction

Managing money in 2025 has never been easier thanks to smart finance apps. Whether you want to budget your expenses, save for the future, or invest in stocks and crypto, these apps provide powerful tools to take control of your financial life.

Here are the Top 4 finance apps in 2025 that you should know.

1. Mint – Personal Budgeting Made Easy

Mint is one of the most trusted apps for personal finance management.

Key benefits:

- Automatically tracks spending and income.

- Budget creation with alerts for overspending.

- Free credit score monitoring.

- Syncs with multiple bank accounts.

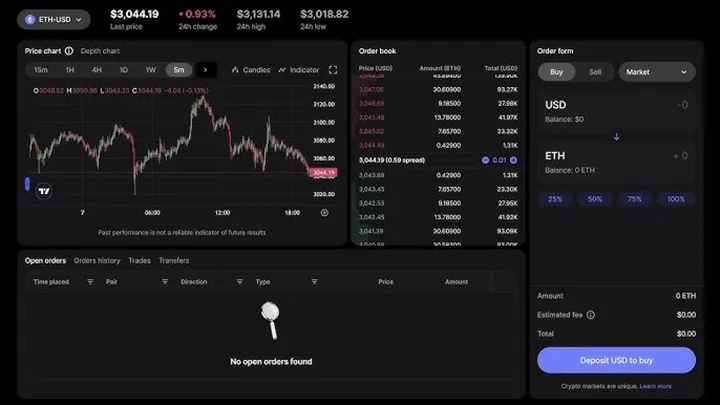

2. Revolut – All-in-One Digital Banking

Revolut has grown into a full digital banking solution.

Key benefits:

- Multi-currency accounts with low fees.

- International transfers at real exchange rates.

- Built-in stock and crypto trading.

- Expense analytics and budgeting tools.

3. Robinhood – Easy Investing for Everyone

Robinhood makes stock and crypto trading simple for beginners.

Key benefits:

- Commission-free trading.

- Real-time market data.

- Fractional shares for affordable investing.

- User-friendly design.

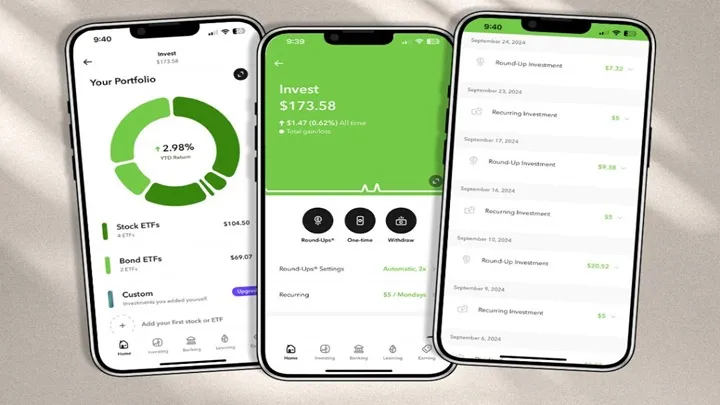

4. Acorns – Invest Your Spare Change

Acorns is perfect for those new to investing.

Key benefits:

- Automatically invests spare change from purchases.

- Easy-to-use savings and investment options.

- Retirement and family accounts available.

- Hands-off approach to growing wealth.

Conclusion

From budgeting with Mint, digital banking via Revolut, investing on Robinhood, to micro-investments with Acorns, these apps are changing the way people manage money in 2025.

Whether you’re saving, spending, or investing, these tools give you the power to take control of your financial future.